SOME people who lost money in the financial turmoil last year may be able to get a measure of tax relief.

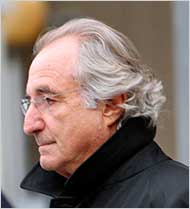

People who invested with Bernard L. Madoff may want to file for an extension on taxes.

The tax code provides help for losses in stocks and mutual funds, in homes that had to be sold or were lost to foreclosure, in the failure of small businesses and in the loss of a job. Special rules apply to losses that occurred through theft — as may be the case for victims of Ponzi schemes, like the one that authorities say was run by Bernard L. Madoff.

The guidelines for these various tax maneuvers can be tricky, so here’s a rough road map:

CAPITAL GAINS AND LOSSES The most important issue, experts say, is whether the loss was actually realized and when it occurred. Only losses realized last year are involved in the tax returns due on April 15.

Imagine an investor bought 1,000 shares of a mutual fund in 2004 at $20 each, for a total of $20,000. If the investor sold them last year at $10 a share, there is a $10,000 capital loss. All of it can be used to offset profits on other stock and mutual fund sales, but those were scarce last year.

And $3,000 of the loss can be used as a deduction against other income, like salaries or interest, said Sidney Kess, a lawyer and accountant in New York. The rest can be pushed forward and used in future years to soak up any future gains and, at a $3,000-a-year clip, to reduce ordinary income, he said.

That is cold comfort, of course, to someone whose losses were followed by five or more zeros. “You’d have to be Methuselah” to use all those losses, said Julian Block, a tax lawyer in Larchmont, N.Y.

Reinvested dividends offer some solace. Investors who earmarked their dividends to buy more shares, and then sold all the shares, have a higher cost than the original purchase price, because the cost of the added shares — namely the amount of the reinvested dividends — must be added, Mr. Block said. That makes the total cost higher and thus the loss greater, though still subject to the $3,000 rule.

A loss, of course, is based on what the stock or mutual fund originally cost, not what it was worth at its peak. So if the hypothetical mutual fund was selling at $60 a share at the beginning of last year, the loss is $10 a share, not $50. The other $40 of loss “just evaporates, because it was never realized,” Mr. Kess said.

The same is true of stock that was beaten down in last year’s crisis but not sold.

“Many people are reluctant to admit they made a mistake, and so they hold onto a losing stock in hopes that it will rise again,” said Mark Luscombe, a lawyer and accountant at CCH, a tax-information provider. Those paper losses don’t count at tax time.

SMALL BUSINESSES There is an exception to the $3,000 rule, Mr. Kess said. People who incorporate small businesses typically get stock called Section 1244 stock in return for their investment. If the business fails, losses of up to $100,000 in such stock can be deducted against ordinary income, he said.

RETIREMENT ACCOUNTS Losses in stocks and mutual funds owned through traditional retirement plans like 401(k)’s, I.R.A.’s and 403(b)’s are not deductible, because the money used to buy the funds was never taxed.

Losses in a Roth I.R.A. can be deductible, said Barry C. Picker, a certified professional accountant and a certified financial planner in Brooklyn. But he cautioned that “you might not want to” take that deduction.

The holder of one or more Roth I.R.A.’s can claim a loss only by liquidating all Roth accounts — you can’t pick and choose between those that have losses and those that don’t. If the sale of all the Roth investments produces a loss, that is deductible.

But once money is removed from a Roth account it can’t be put back in later.

FORECLOSURES The collapse of the housing market poses different tax issues. Selling a home at a loss does not produce a taxable loss, unless part of the home was used as an office or for rental or business purposes — and then only part of the loss is deductible.

If part of a mortgage loan is forgiven — perhaps as part of a foreclosure — “phantom income” is created, unless the borrower is insolvent or has declared bankruptcy. Congress has provided relief. “If a lender forecloses on your home, sells the home for less than the outstanding mortgage, and forgives all or part of the mortgage debt, the canceled debt is generally included in your taxable income,” CCH said in a report on highlights of legislative changes. “However, under this provision, if you took out the mortgage to buy, build or substantially improve your home, you can exclude up to $2 million of canceled debt from your gross income.”

The rule also applies to refinanced mortgages that replace ones used to build, buy or improve, CCH reported. And it covers other mortgage-reduction agreements.

Someone who is fortunate enough to negotiate a reduction in credit card debt does not benefit from these rules.